The Mortgage Agent Advantage

Increasingly, Canadians are turning to mortgage agents for their first and next mortgage, taking advantage of the value and convenience of their services. One of their most compelling reasons to work with a mortgage agent is that they have access to a wide range of lending sources, making it significantly easier to match borrowers with the mortgage product that best suits them. When you’re dealing directly with one financial institution, you just don’t know if you’re getting the best deal because they’ve only got their own menu of products to offer you.

With Dominion Lending Centres, you are dealing with one of the largest mortgage brokers in the country, and you’ll enjoy considerable bargaining power. A large brokerage has clout with lenders to negotiate volume discounts that lead to lower rates and greater product choice than other companies. And, mortgage agents are generally paid by the lender rather than the borrower, making it a logical choice to always consult with a mortgage broker. They’re shopping the market for the best rates, doing all the work, and there’s no cost to you.

But a mortgage agent's role extends beyond securing financing – to arranging the home appraisal and lawyer or notary, reviewing the purchase contract and statement of adjustments, securing mortgage life insurance, and keeping tabs on the entire closing process. And that’s just during the mortgage transaction. We stay in touch, keeping clients apprised of new mortgage offers and rate fluctuations, and advising when to lock in a variable-rate mortgage.

Ultimately, the role of your mortgage agent is that of a trusted advisor and it’s a relationship that can last a lifetime. Many mortgage agents clients have been referred by word of mouth, and many are even second, or third, generation client families.

Whether you’re taking on your first mortgage or a long-time homeowner looking to refinance, consolidate debt or leverage your equity to acquire a new property, a mortgage agent is a wealth of information. They can advise about down payment requirements, mitigating credit history issues, mortgage payment and prepayment options, interest-saving strategies, purchasing vacation, investment and commercial properties, qualifying with supplemental rental income, and mortgage options for new immigrants.

When you get a mortgage, likely the biggest financial commitment you’ll make in a lifetime, it’s critical that the person you’re dealing with is knowledgeable, able to answer your questions, and has access to a full range of lenders so you get the best mortgage for your needs.

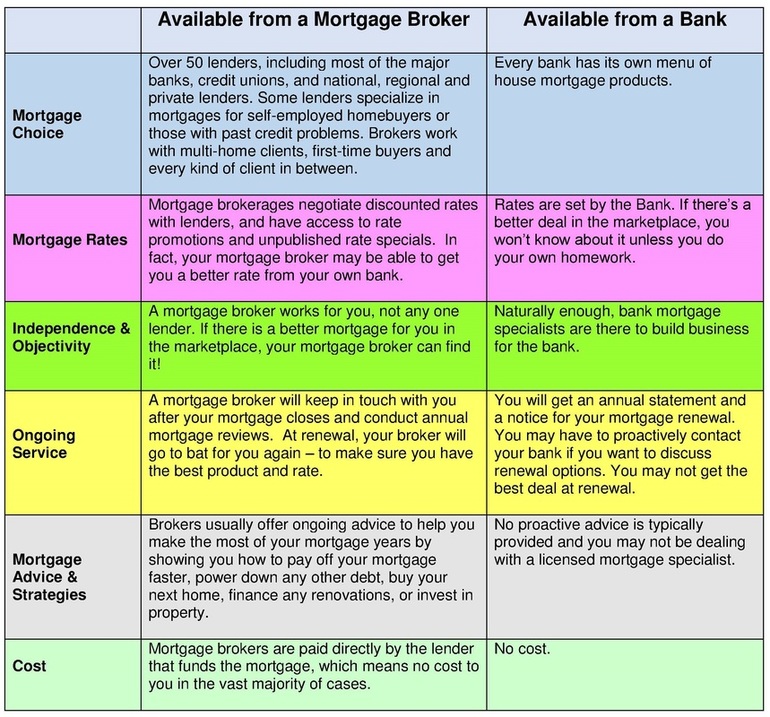

So what will it be? Bank or a reputable mortgage brokerage? Here’s a little comparison that we hope will encourage you to shop around.

Increasingly, Canadians are turning to mortgage agents for their first and next mortgage, taking advantage of the value and convenience of their services. One of their most compelling reasons to work with a mortgage agent is that they have access to a wide range of lending sources, making it significantly easier to match borrowers with the mortgage product that best suits them. When you’re dealing directly with one financial institution, you just don’t know if you’re getting the best deal because they’ve only got their own menu of products to offer you.

With Dominion Lending Centres, you are dealing with one of the largest mortgage brokers in the country, and you’ll enjoy considerable bargaining power. A large brokerage has clout with lenders to negotiate volume discounts that lead to lower rates and greater product choice than other companies. And, mortgage agents are generally paid by the lender rather than the borrower, making it a logical choice to always consult with a mortgage broker. They’re shopping the market for the best rates, doing all the work, and there’s no cost to you.

But a mortgage agent's role extends beyond securing financing – to arranging the home appraisal and lawyer or notary, reviewing the purchase contract and statement of adjustments, securing mortgage life insurance, and keeping tabs on the entire closing process. And that’s just during the mortgage transaction. We stay in touch, keeping clients apprised of new mortgage offers and rate fluctuations, and advising when to lock in a variable-rate mortgage.

Ultimately, the role of your mortgage agent is that of a trusted advisor and it’s a relationship that can last a lifetime. Many mortgage agents clients have been referred by word of mouth, and many are even second, or third, generation client families.

Whether you’re taking on your first mortgage or a long-time homeowner looking to refinance, consolidate debt or leverage your equity to acquire a new property, a mortgage agent is a wealth of information. They can advise about down payment requirements, mitigating credit history issues, mortgage payment and prepayment options, interest-saving strategies, purchasing vacation, investment and commercial properties, qualifying with supplemental rental income, and mortgage options for new immigrants.

When you get a mortgage, likely the biggest financial commitment you’ll make in a lifetime, it’s critical that the person you’re dealing with is knowledgeable, able to answer your questions, and has access to a full range of lenders so you get the best mortgage for your needs.

So what will it be? Bank or a reputable mortgage brokerage? Here’s a little comparison that we hope will encourage you to shop around.